Trading micro futures for beginners. Futures trading is one method for investors looking to maximize profits.

S&P 500 Futures Trading Outlook For June 26, 2017 See It

S&P 500 Futures Trading Outlook For June 26, 2017 See It

Targets trading pro is an automated futures trading bot that can help you eliminate the guesswork when trading futures.

Trading futures. Crude oil futures , and more specifically, ‘light sweet crude oil futures’ are traded on the nymex exchange (new york mercantile exchange). Futures trading basics can be an exciting way to diversify holdings. Bitcoin futures trading fees are slightly different to spot trading and may include:

Trading futures is easy even for beginners than trading actual cryptocurrencies, which requires you to access a liquid market and have a secure digital wallet. Consider selecting a broker who supports the products and markets you are interested in trading. This module covers the various intricacies involved in undergoing a futures trade

In simple terms, it is the underlying market where bitcoins are exchanged. Coverage of premarket trading, including futures information for the s&p 500, nasdaq composite and dow jones industrial average. Fees can apply if you extend a bitcoin futures contract beyond its close date.

You need to be aware that the margin requirements are higher when attempting to swing trade futures. Usually, most futures result in a cash settlement, instead of a delivery of the physical commodity. Develop your knowledge of financial markets.

Cory mitchell, cmt, is a day trading expert with over 10 years of experience writing on investing, trading, and day trading. Margin trading of futures can increase your gains but also put you at higher risk. The futures markets are regulated by the commodity futures trading commission (cftc).

As with all trading, make sure you know your limits and buy/sell with a plan, not just on instinct or gut feel. In fact, this is why the trading volume in crypto futures is two to three times larger than spot trading volumes. Futures spread is a trading technique where you open a long and a short position simultaneously to take advantage of a price discrepancy.

At the time, the spot price stood at around $1,600. The cftc is a federal agency created by congress in 1974 to ensure the integrity of futures market pricing. While swing trading stock and forex are more popular, futures are also suitable for swing trading.

Difference between bitcoin spot market and bitcoin derivatives market spot market. Sign up for our 1 week demo trial! Mitchell founded vantage point trading, which is a website that covers and reports all topics relating to the financial markets.

Contract language that allows adjustments to be made to the premium and commission features of a reinsurance treaty. However, any individual investor with a margin account can participate in futures trading. The idea behind futures spread trading strategies is to reduce the risk.

For example, if you have a $10,000 trading account and lost $1,000 in an open futures position, that loss would be reflected against your margin requirements at the end of the day. In this article, we’ve prepared our favourite futures trading. Much like spot trading, bitcoin futures contracts will typically charge a commission for a buy or sell.

Futures are a popular trading vehicle that derives its price from the underlying financial instrument. Our top futures market is crude oil and many traders will agree that crude oil is a great market for trading futures with a day trading strategy, scalping, or even holding for swing trades. Guide on trading bitcoin futures:

Swing trading futures is the only multisession system on our futures trading toolbox. But this particular trading instrument, which involves an agreement to buy or sell an asset at a predetermined future price. In the bitcoin spot market, investors own, buy, and sell actual bitcoin.

How to trade bitcoin futures? The futures price is the price that you lock in when trading a futures contract, and it is what you will be able to buy or sell an underlying market for at or before the contract’s expiry date. Futures trading is an investing activity typically reserved for speculators or companies that are looking to hedge against the future price of their products.

An adjustable feature may include such features as sliding. Futures trading history is as simple as understanding the concept of farmers planting crops every spring, and then, every fall, farmers harvesting grain and locking in prices early in the season. These are futures for the four major u.s.

Many securities brokers are also registered to deal in futures. Futures trading involves trading in contracts in the derivatives markets. The last trading day of oil futures, for example, is the final day that a futures contract may trade or be closed out prior to the delivery of the underlying asset or cash settlement.

In the futures business, brokerage firms are known as either a futures commission merchant (fcm) or an introducing broker (ib).

Basics of Futures Trading Explained NeuroStreet Inc.

Basics of Futures Trading Explained NeuroStreet Inc.

Futures Trading Secrets velocityspark

Futures Trading Secrets velocityspark

The Ins And Outs Of Futures Spread Trading Binance Smart

The Ins And Outs Of Futures Spread Trading Binance Smart

What Are Future and How To Trade Them ClayTrader

What Are Future and How To Trade Them ClayTrader

The Futures Trading Strategies to Use (and the ones to

The Futures Trading Strategies to Use (and the ones to

trading for a living sunday night trading futures bonds

trading for a living sunday night trading futures bonds

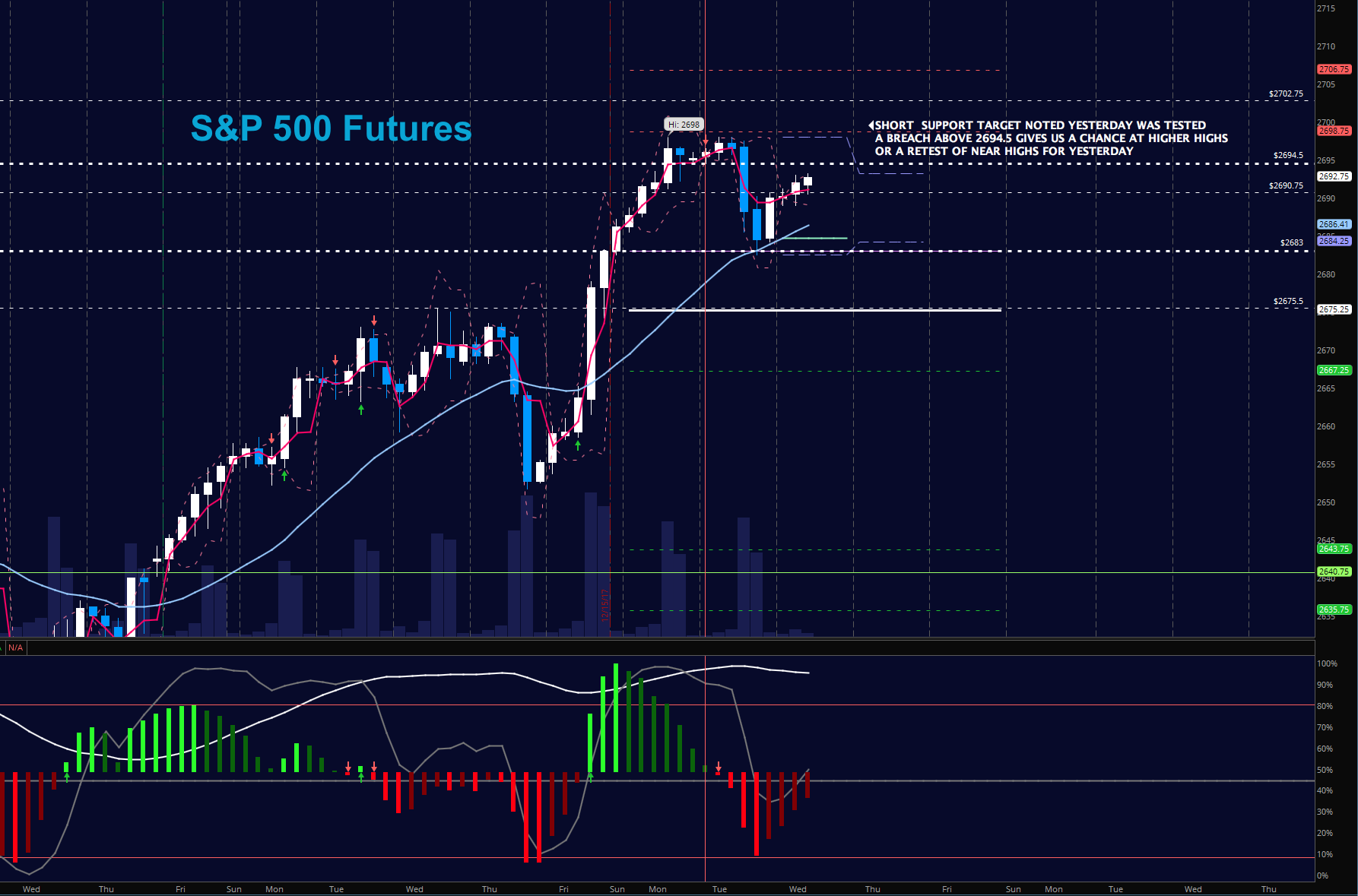

Stock Market Futures Trading Outlook For December 20 See

Stock Market Futures Trading Outlook For December 20 See

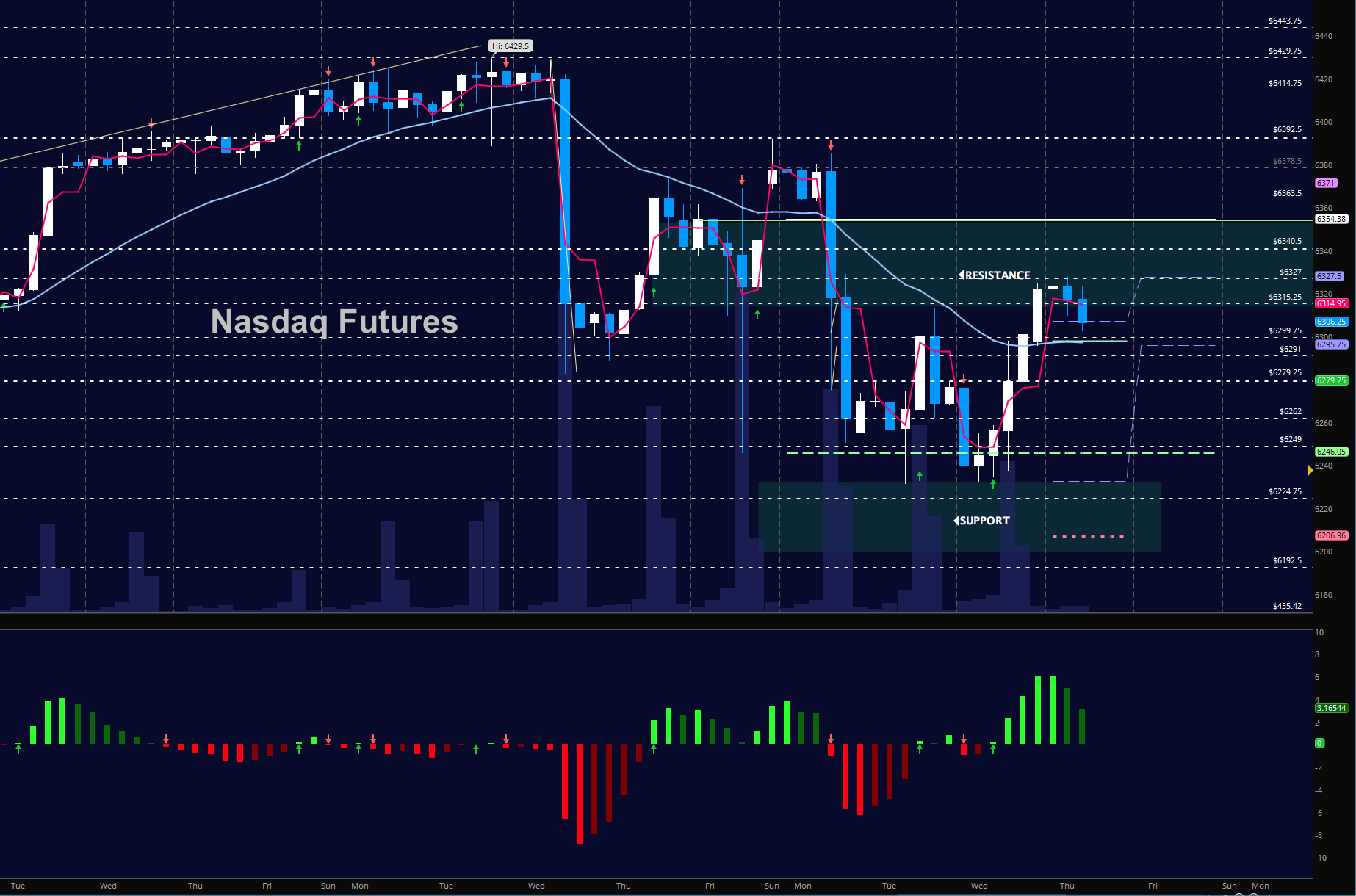

New Trading Setups From ReInventing My Trading Strategy

New Trading Setups From ReInventing My Trading Strategy

Free Futures Trading Guides and EBooks Daniels Trading

Free Futures Trading Guides and EBooks Daniels Trading

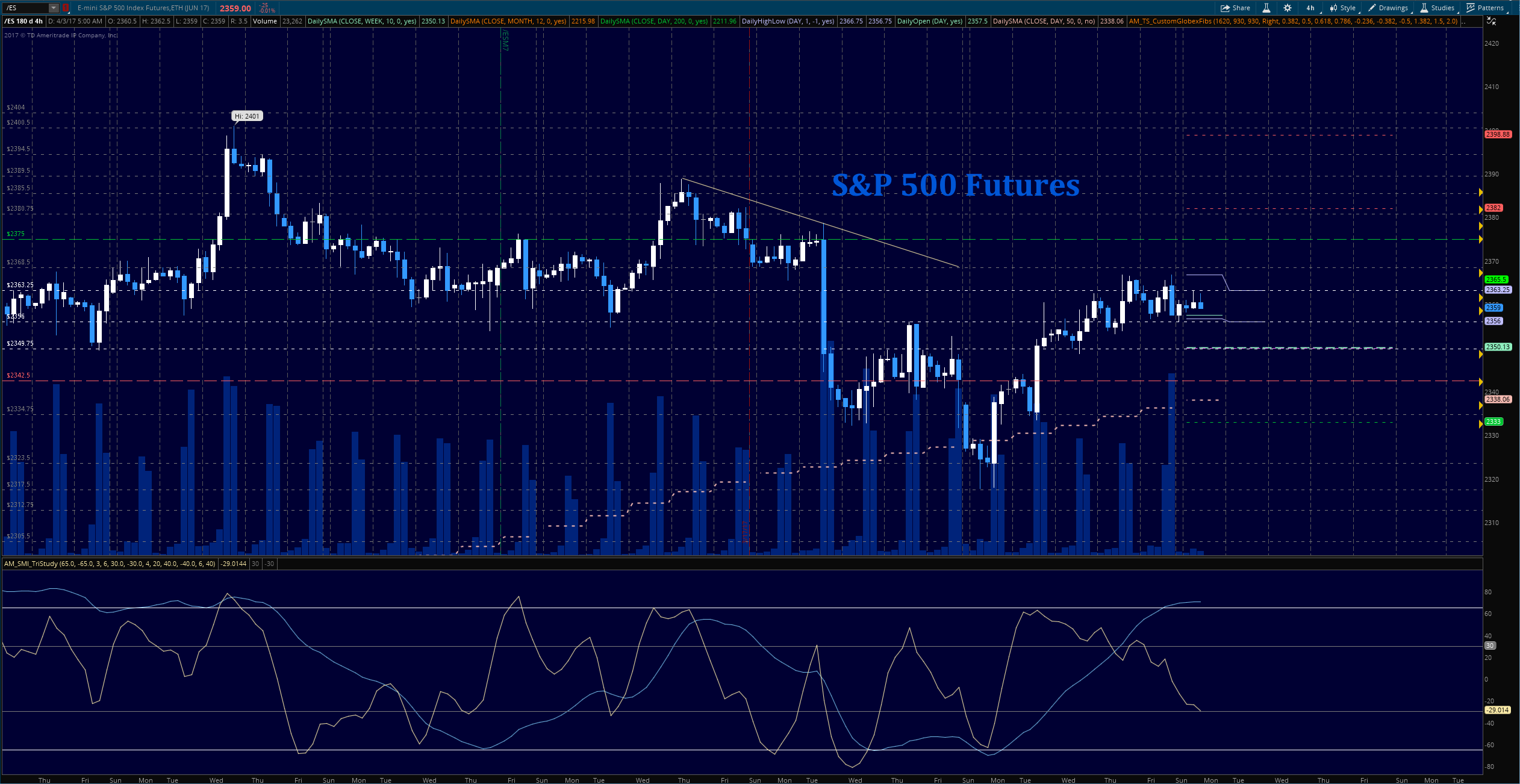

S&P 500 Futures Trading Outlook For April 3 See It Market

S&P 500 Futures Trading Outlook For April 3 See It Market

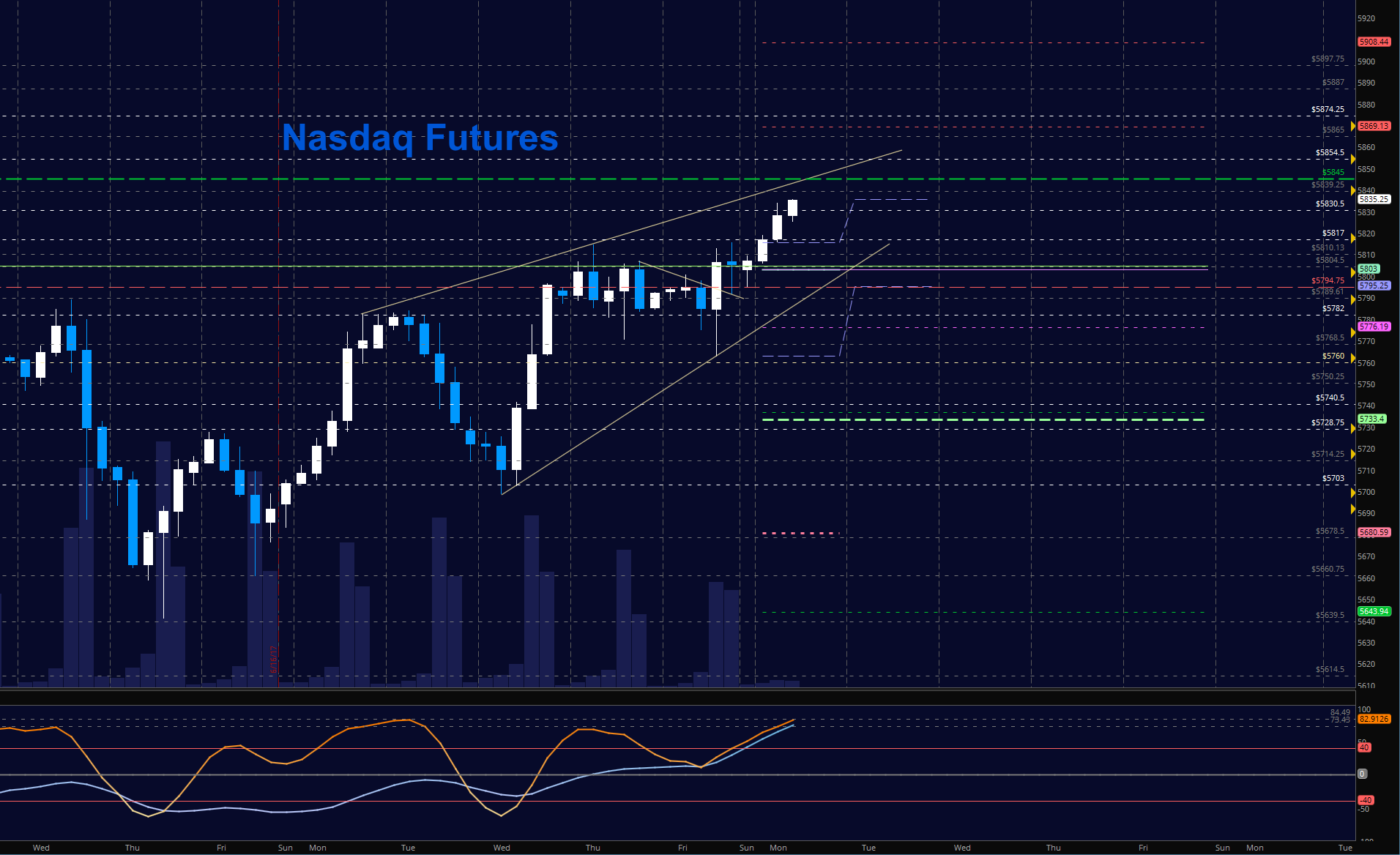

Stock Market Futures Trading Setups For January 22 See

Stock Market Futures Trading Setups For January 22 See

Futures Trading Report (February) Retracement or Trend

Futures Trading Report (February) Retracement or Trend

5 Advantages of Trading Futures Daniels Trading

5 Advantages of Trading Futures Daniels Trading

S&P 500 Futures Update Price Support Holding... For Now

S&P 500 Futures Update Price Support Holding... For Now

The Biggest Advantages of Trading Futures

The Biggest Advantages of Trading Futures

/close-up-of-abstract-pattern-767984067-5b8830e2c9e77c0050f04f94.jpg) Minimum Capital Required to Start Day Trading Futures

Minimum Capital Required to Start Day Trading Futures

Futures trading course This futures trading course

Beginner's Guide To Trading Futures Trading Futures For

Beginner's Guide To Trading Futures Trading Futures For

No comments:

Post a Comment