Second, drawing the triangle patterns is usually relatively easy as you have seen above. In fact, the trend continues in the direction it was going.

Triangle Chart Patterns and Simple Ways to Trade Them

Triangle Chart Patterns and Simple Ways to Trade Them

Upl formed descending triangle pattern.

Triangle pattern trading. A triangle chart pattern involves price moving into a tighter and tighter range as time goes by and provides a visual display of a battle between bulls and bears. Triangles are a continuation pattern—meaning they’re not marked by a price reversal. The triangle pattern appears on different charts rather frequently.

Wedge patterns are associated with a fast descent in price at a fairly steep angle. There are several benefits of using triangle patterns when trading. Everyone that has been trading, even for a short while, knows for sure that textbook stuff and reality on charts are different.

The descending triangle chart pattern is formed when the resistance drops and the support levels remain flat. However, in my opinion, this pattern may equally work in line with or against the existing trend. When you spot a descending triangle pattern, you should be aware that the futures price will go up and down within the figure until the support and resistance levels merge.

Triangle pattern forex trading strategy There are basically 3 types of triangles and they all point to price being in consolidation: An understanding of these three forms will give you an ability to develop breakout or anticipation strategies to use in your day trading, while allowing you to manage your risk and position size.

Triangles can be best described as horizontal trading patterns. A triangle is a polygon with three edges and three vertices. Description of the triangle pattern.

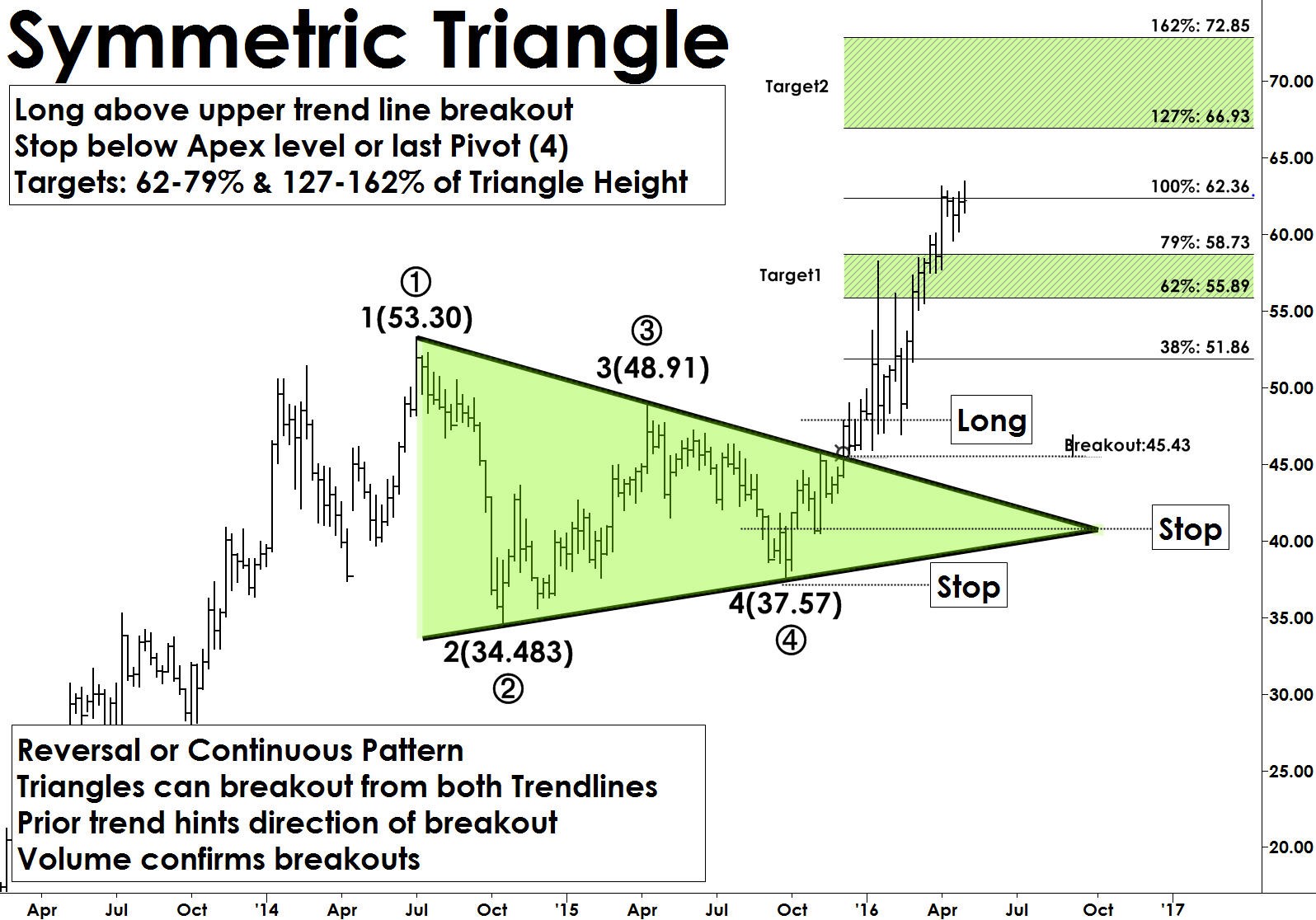

Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting as resistance and an. On the daily chart of eur/usd, the intersection of a rising trendline and a downward line within a large downtrend formed the desirable pattern. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting as resistance and an.

A symmetrical triangle has a wide trading range at the beginning of the pattern and compresses to a very small range as the patter plays out. A wedge pattern is very similar to a triangle pattern, except the two trendlines to not intersect (at least not at any point soon). The triangle pattern also provides trading opportunities, both as it is forming and once it completes.

Typically, a security’s price will bounce back and forth between the two trendlines, moving toward the apex of the triangle, eventually breaking out in one direction or the. Once this happens, a breakout follows and a downtrend movement. A triangle pattern forms when a stock’s trading range narrows following an uptrend or downtrend, usually indicating a consolidation, accumulation, or distribution before a continuation or reversal.

And it’s pretty simple — it’s a triangle that’s going up on a chart. Triangle pattern trading is a strategy many day traders use to enter and exit their positions with confidence as prices stabilize. Generally, we draw the triangle pattern to highlight these ranging areas.also read about trader's tech and installing mt4 eas with indicators.

It is a pattern that shows how traders’ excitement and trading activity starts strong then gradually dissipates and dies out before the market decides as to where price should be. At the start of its formation, the triangle is at its widest point. For those who understand this chart pattern and trade it correctly, it’s a trading strategy that can result in big profits.

First, the patterns are usually easy to spot, even among new traders. Ascending triangle patterns can be a great pattern to help you find breakouts before they happen. In this trading guide, you will learn how to trade the descending triangle pattern like a seasoned professional.in the technical world of trading, there are many different patterns to be aware of that will allow you to make more informed trading decisions.

One of the most popular, and commonly seen pattern is the triangle pattern. Trading strategies for different types of triangle pattern at first, let’s consider the situation when a symmetrical triangle occurs. In general, there are three types of triangle patterns:

The classic technical analysis considers it a pattern signifying the continuation of the trend; The best thing about pattern trading is that it applies to all timeframes, from m1, m5, m15, h1, h4, up to the day by day timeframe, and to every types of trading, either it be scalping, day trading, or swing trading. This is the reason why the ascending triangle pattern is a favorite among many stock traders.

Who would have thought your preschool teacher was prepping you for day trading? Wedge patterns are powerful bullish reversal signals and represent low risk and high reward opportunities. That is the simple geometric definition of a triangle.

As the market continues to trade in a sideways pattern, the. The symmetrical triangle trading strategy is one of the most proficient ways to trade consolidations because the triangle pattern generally occurs during ranging periods. Be mindful of the trend direction previous to the triangle formation.

The triangle pattern is generally categorized as a “continuation pattern”, meaning that after the pattern completes, it’s assumed that price will continue in the trend direction it was moving before the pattern appeared. Advantages of the triangles pattern. I am eagerly waiting for your reply whether it good or bad just reply to this article.

So let’s start looking at some guidelines on how to identify a triangle pattern. The symmetrical pattern creates a coil and contains at least two lower highs and two higher lows for a compression of the price range into an apex point. There are basically 3 types of triangles and they all point to price being in consolidation:

The triangle pattern in forex is a price formation that signals a potential trend continuation after a brief consolidation. The triangle chart pattern is formed by drawing two converging. Finally, you don’t need to use technical indicators to use the triangle pattern well.

There are several types of the triangle, each of them having its own specific features. Pattern day or swing trading is a identical use of tool forex traders can incorporate in their store of trading setups. This triangle pattern is formed as gradually ascending support lines and descending resistance lines meet up as a security’s trading range becomes increasingly smaller.

Stock trading is no different, it’s all about being in the right position at the right time. Either way, pattern trading, coupled with a good money management system, is profitable.

How to trade triangle chart patterns Ocblog

How to trade triangle chart patterns Ocblog

The Ultimate Guide To Trading Triangle Patterns New Trader U

The Ultimate Guide To Trading Triangle Patterns New Trader U

3 Easy Triangle Patterns Every Forex Trader Should Know

3 Easy Triangle Patterns Every Forex Trader Should Know

Triangle Chart Patterns Trading Strategy That Works

Triangle Chart Patterns Trading Strategy That Works

3 Easy Triangle Patterns Every Forex Trader Should Know

3 Easy Triangle Patterns Every Forex Trader Should Know

3 Easy Triangle Patterns Every Forex Trader Should Know

3 Easy Triangle Patterns Every Forex Trader Should Know

a Forex Trader Trading charts, Forex training

a Forex Trader Trading charts, Forex training

Forex trading strategy with Triangle pattern in Olymp Trade

Forex trading strategy with Triangle pattern in Olymp Trade

Forex Price Action Symmetrical Triangle MT4 Chart

Forex Price Action Symmetrical Triangle MT4 Chart

Ascending Triangle Pattern 📌 in 2020 (With

Ascending Triangle Pattern 📌 in 2020 (With

Forex Chart Patterns for Intraday Trading [Examples

Forex Chart Patterns for Intraday Trading [Examples

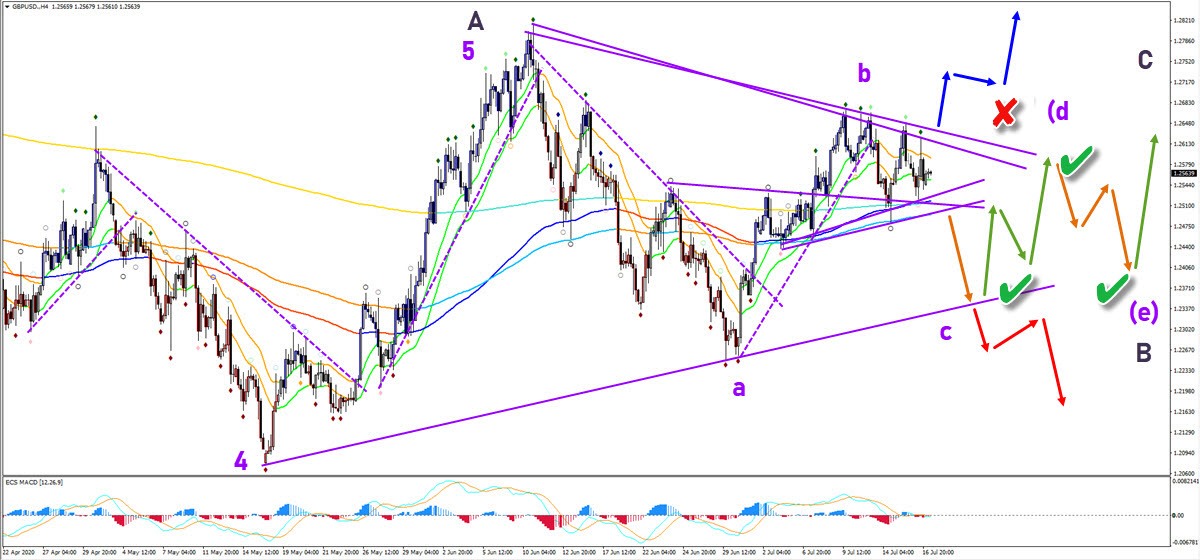

GBP/USD triangle pattern offers plenty of trading ideas

GBP/USD triangle pattern offers plenty of trading ideas

Day Trading Triangle Patterns Tuesday Crude Oil, Gold, E

Day Trading Triangle Patterns Tuesday Crude Oil, Gold, E

GoPro Inc (GPRO) Reveals How To Trade Triangle Breakouts

GoPro Inc (GPRO) Reveals How To Trade Triangle Breakouts

Crude's Profitable Breakout/Breakdown Symmetric Triangle

Crude's Profitable Breakout/Breakdown Symmetric Triangle

symmetrical triangle Поиск в Google {More on Trading

symmetrical triangle Поиск в Google {More on Trading

Enhance Forex Trading Using One Of The Three Triangle

Enhance Forex Trading Using One Of The Three Triangle

Symmetrical Triangle Trading Pattern TradingNinvestment

Symmetrical Triangle Trading Pattern TradingNinvestment

Master Trading Triangle Patterns to Increase Your Win Rate

Master Trading Triangle Patterns to Increase Your Win Rate

No comments:

Post a Comment