If you have been referred to us please enter the name. Arbitrage has the effect of causing prices of the same or very similar assets in different markets to converge.

Is arbitrage trading a sure win strategy in crypto trading

Is arbitrage trading a sure win strategy in crypto trading

Simply put, arbitrage is a form of trading in which a trader seeks to profit from discrepancies in the prices of identical or related financial instruments.

Trading arbitrage. To understand more about this concept and different types of arbitrage, read trading the odds with arbitrage. Crypto arbitrage software is mostly used to create your trading strategy or a bot without specific coding skills. Trading the odds with arbitrage.

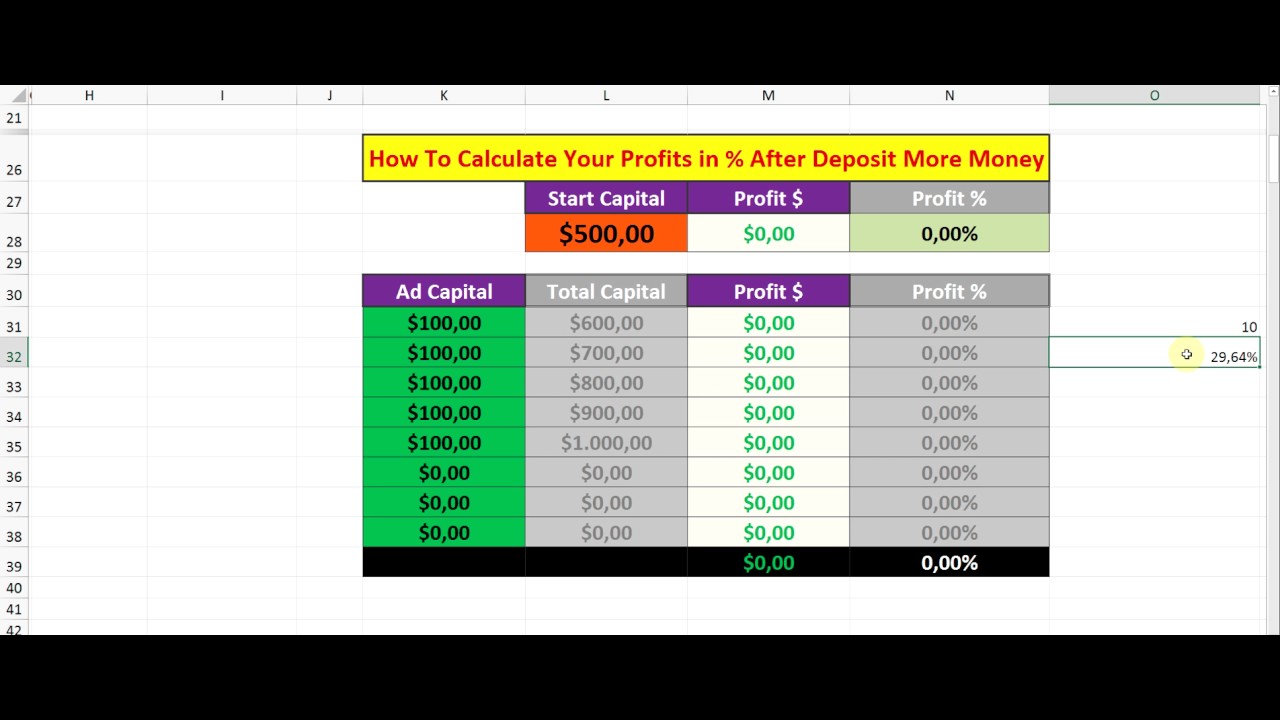

Apa itu arbitrase dalam forex? Keuntungan trading arbitrage bisa dihitung dengan cara: Transfer 5000 usdt to the futures account and the rest 5000 usdt to the trading account.

Mainly through the purchases of digital currency on one exchange for a lower price and quickly selling it on another one at a higher rate simultaneously. A highly profitable triangular arbitrage trading system available to everyone. The term is mainly applied to trading in financial instruments, such as bonds, stocks, derivatives, commodities, and currencies.

The software is a more complicated and comprehensive tool for crypto arbitrage than robots, as bots are just a part of them. This is made possible because the price differences in different markets are not completely correlated and always a minute difference between them. Mutual funds are owned by a group of investors and managed by professionals.

Nilai trigger harus merupakan jumlah spesifik, idealnya berasal dari semacam analisis risiko yang memperhitungkan volatilitas. Investing at least 5000 eur in such suspicious services is too risky. The net difference in the two interest rates is the trading profit.

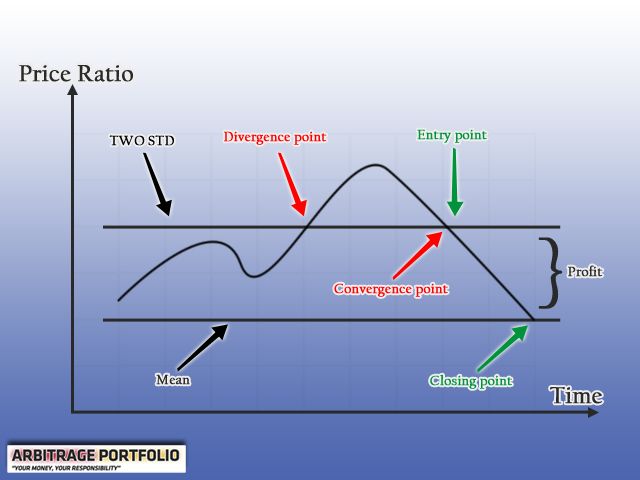

Different types of arbitrage allow trading across different platforms or trading pairs. Arbitrage is a necessary force in the financial marketplace. Kita sudah bisa memulai trading jika selisih (spread) sudah melewati nilai trigger awal.

Sign in create an account. Conclusion of algofx arbi & arbitrage trading. Arbitrage, according to investopedia, is “the purchase and sale of an asset in order to profit from a difference in the asset’s price between markets.” in essence, it’s buying an item from a particular market and then immediately selling it in another market that accepts it, but at a higher price.

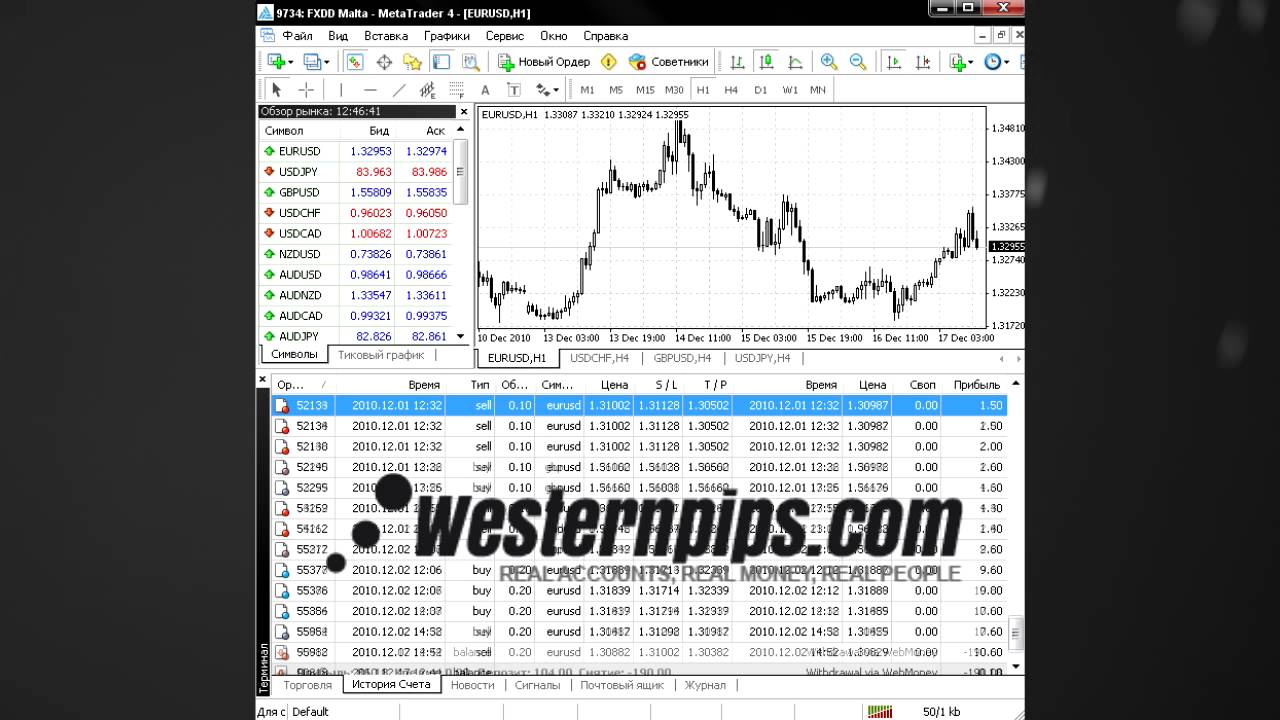

In fx, latency arbitrage typically is price latency arbitrage where a trader finds delayed prices. Arbitrage ct is a truly new, unparalleled, instrumental trading tool for crypto currency, allowing you to trade on several exchanges for several pairs simultaneously! To register you only need to fill in the registration form.

Before talking about arbitrage in forex trading, it is important to define arbitrage in general. For example, consider developing countries or less developed countries; Arbitrage environment can occur at any opportunity.

It can be defined, in broad terms, as selling the commodity purchased at a low price at a high price in a different market. Find out more about our product by reading our website to the end. Next, let’s discuss how to execute the arbitrage by ourselves.

Arbitrage is the strategy of exploiting price differences in the various financial market instruments. Here’s how we’re going to do: Linkage is the ability to buy a security on one financial exchange and sell the same security on another exchange.

Arbitrage can be done through the trading of commodities in different cities of a country. However, it is a service provided by an unknown broker. Since the forex markets are decentralized, there are moments where a currency traded in one place is somehow quoted differently from another trading location.

Arbitano indonesia 100% disentralisasi join now tutorial vidio buy on uniswap crowdfunding internasional platform generasi baru teknologi revolutionary smart contract * memberi peserta pasar yang terdesentralisasi kemampuan untuk terlibat langsung dalam transaksi pribadi dan bisnis.kontrak cerdas proyek matriks terdesentralisasi arbitano tersedia untuk umum dan selalu tersedia untuk dilihat di. Strategies are based on particular indicators. Funds are held in usd.

People who engage in arbitrage are called arbitrageurs / ˌ ɑːr b ɪ t r ɑː ˈ ʒ ɜːr /. Crypto arbitrage is a trading strategy that exploits the price differences of an asset. Dalam trading forex, cara untuk mendapatkan profit biasanya adalah dengan mengantisipasi arah pergerakan harga di masa depan.

Arbitrage trading is the practice of buying shares of a company in one market and selling it in another market for a profit.

Why Arbitrage is a Sustainable Trading Strategy in the

Why Arbitrage is a Sustainable Trading Strategy in the

Latency arbitrage trading Activtrades Broker 900 Profit

Latency arbitrage trading Activtrades Broker 900 Profit

Arbitrage Trading Software With no losses YouTube

Arbitrage Trading Software With no losses YouTube

Forex Arbitrage Trading Newest Pro 100 profit YouTube

Forex Arbitrage Trading Newest Pro 100 profit YouTube

Arbitrage trading software YouTube

Arbitrage trading software YouTube

ARBITRAGE CRYPTO TRADING BOT write on wall "Global

ARBITRAGE CRYPTO TRADING BOT write on wall "Global

Online Arbitrage With 0 From Reselling To Trading

Online Arbitrage With 0 From Reselling To Trading

Build profitable arbitrage trading bot for all exchange by

Build profitable arbitrage trading bot for all exchange by

Arbitrage Trading Overview Concepts Need To Understand

Arbitrage Trading Overview Concepts Need To Understand

Arbitrage Trading Clipboard image

The Basics of Arbitrage Trading in Cryptocurrencies

The Basics of Arbitrage Trading in Cryptocurrencies

How to PROFIT from ARBITRAGE TRADING explained! YouTube

How to PROFIT from ARBITRAGE TRADING explained! YouTube

Arbitrage Forex Trading YouTube

Arbitrage Forex Trading YouTube

Realtime arbitrage trading YouTube

Realtime arbitrage trading YouTube

Statistical Arbitrage Is Trading Jargon for Pairs Trade

Statistical Arbitrage Is Trading Jargon for Pairs Trade

Was ist Arbitrage Trading? Arbitrage Trading

Was ist Arbitrage Trading? Arbitrage Trading

Full Arbitrage Trading Tool of Mike Perona is a DANGEROUS

Full Arbitrage Trading Tool of Mike Perona is a DANGEROUS

No comments:

Post a Comment