In this article, i'll go over the details of how i trade with that specific strategy. The last benefit of using a simple swing trading strategy is that you won't need to be glued to the screen for the whole day like with day trading strategies.

Biggest Tip For London Breakout Trading Session...

Swing trading strategy to participate in medium to long term trends.

Swing london session forex trading strategies. There are typically stop orders clustered above the session high and below the session low from people who placed trades earlier in the session. Because london is in a different timezone, the market opens several hours before exchanges in new york. That means, these swing trading strategies must allow you to buy when a downswing is ending in an uptrend and sell when an upswing is ending in a downtrend.

Like any trading strategy, swing trading also has a few risks. Apart from the fact the many forex swing traders like to use different swing trading strategies. Using no basic indicators but trendline.

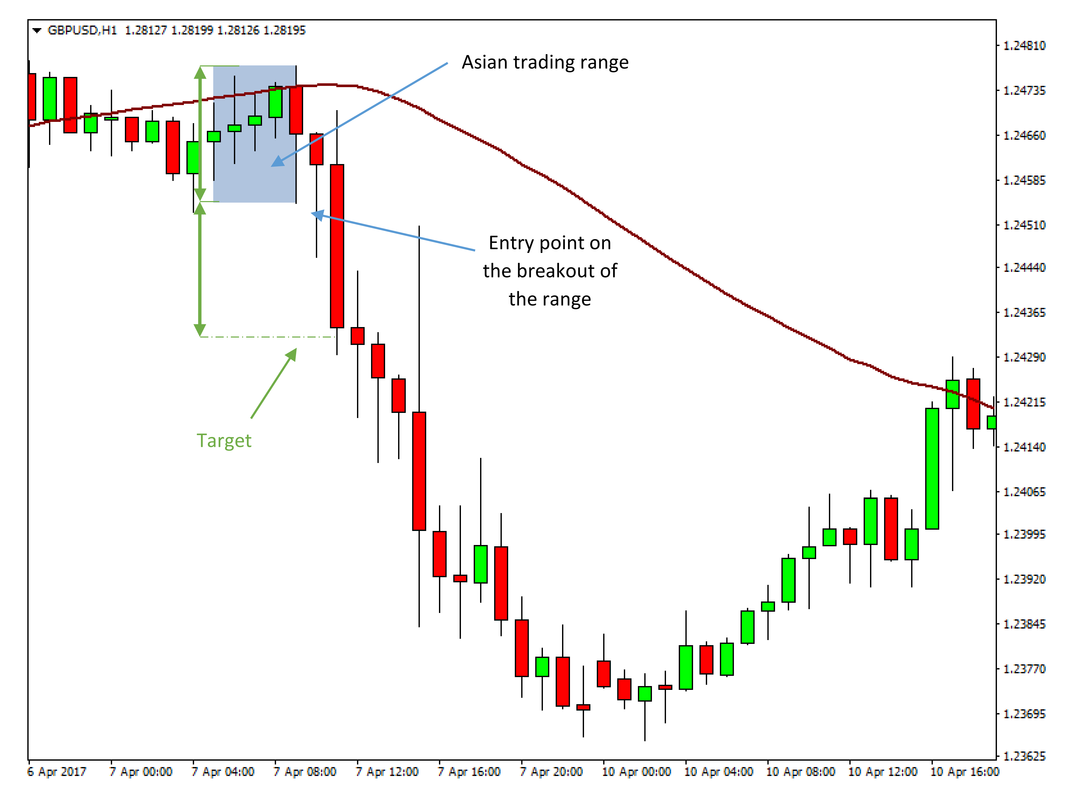

London box retest strategy is a strategy that makes use of and profits from the directional hints that occurs during the london trading session. What is so special about the time when the asian session dies off and the london session begins that there is a system called asian session breakout? The london breakout strategy takes advantage of the trading range that sets up generally during the asia session in forex.

Also known as the london daybreak strategy, it’s a day trading strategy that looks to be active during the first three hours of the london market session. In todays live forex day trading video we covered aud/usd day trading opportunity we took today in london trading session. In the forex market, swing trading allows traders to benefit from excellent liquidity and enough volatility to get interesting price moves, all within a relatively short time frame.

When day trading forex, i use this strategy to capitalize when the price of the eurusd nears the session (london or new york) high or low. Gann fisher trend forex swing trading strategy. This gives traders a unique opportunity to enter into new positions.

We took this trade together with our forex mentoring students since we. Submit by janus trader 08/01/2012 this london breakout strategy was based on price breakout of the trendline. There are typically stop orders clustered above the session high and below the session.

Knowledge and understanding of intraday cycles in forex is a very powerful tool. Wants to take advantage of the usual breakout move that happens during the london and new york session. Swing trading is looking to profit from the next swing the markets make.

The london trading session is one of the most active periods in the fx market and the london open in particular can provide some interesting trading opportunities. Although the article is about day trading, the strategy i'll present is actually traded at night (during the tokyo session). The london breakout strategy is a momentum trading strategy that uses the coiled up energy from the asian session.

As a swing trader you will often be using the higher time frames such as the 4 hour and daily charts and looking to capture large market swings and moves. In general, the asian session is a quiet time to trade. The best times to trade the pairs below are from 8:00 am to 12:00 pm est because this is when both new york and london sessions are active.

A swing trading plan will work in all markets starting from stocks, commodities, forex currencies, and much more. The yen is the third most traded currency, which volume is participating in almost 17% of all forex transactions. To trade the london breakout strategy:

I'm not going to compare swing and day trading here…that's not the point. The 15 min scalping strategy uses only the standard rsi indicator that comes with your standard mt4 trading platform. Ideally, you want forex trading strategies that are ideal for swing trading.

The 20 pips asian session breakout forex trading strategy allows you to trade breakouts upon the the opening of the london trading session. It gives traders an idea as to the reasons behind certain sudden spikes in volume which often lead to directional moves. Has behind real selling pressure.

This strategy helps traders wade through the false moves that can occur at the start of the. Trade management and stop out You really don’t need any fancy indicators to do well with this strategy… or in fact to do well in forex.

My favorite forex day trading strategy: Don’t pay too much attention to fancy indicators created by forex marketers. The session times are important to consider when choosing currency pairs, for example eur or gbp pairs should be traded in the london forex trading session.

The london session breakout strategy provides excellent opportunities to profit on the high volatility and volume beginning at the opening of the london trading session at 7 am gmt and lasting for the next 3 hours into the session. Now, we don’t know which way the range bound asian market will breakout during the london session. Top 10 best forex trading strategies pdf report.

In simple terms, the london breakout strategy 2020 is a day trading strategy that seeks to take advantage of the trading range prior to the london opening session. What we do know is that when the forex market opens in london, we will get an increase in trading volume. When day trading forex, i use this strategy to capitalize when the price of the eurusd nears the session (london or new york) high or low.

Swing trading strategies can be used on a range of instruments, including etfs, futures and all cfd instruments, including, stocks, forex, commodities and even indices. The trading floor is updated before the london trading session opens at 7:00 a.m gmt for all clients to ensure they are aware of all trading opportunities before the major moves in the financial markets take place. This strategy using 1 hour chart timeframe and recommended pair to trade were gbp/usd and eur/usd.

forex basics forexlearntotrade (With images) Learn

forex basics forexlearntotrade (With images) Learn

London Day Break Trading Indicator

London Day Break Trading Indicator

2 Best Forex Trading Times And Why You Have To Trade In Them

Forex London Session Breakout 1 Min Easy Forex Scalping

Forex London Session Breakout 1 Min Easy Forex Scalping

How To Trade The London Breakout Strategy For Forex

London DayBreak Strategy XAUUSD 22nd Feb 2019 Free

London DayBreak Strategy XAUUSD 22nd Feb 2019 Free

Live from London Forex Trading Session. YouTube

Live from London Forex Trading Session. YouTube

Forex Easy M15 Trading the London and New York Session

Forex Easy M15 Trading the London and New York Session

London DayBreak Strategy A Powerful Day Trade Scalping

London DayBreak Strategy A Powerful Day Trade Scalping

FX SCALPING LONDON SESSION, S1 EP6, BUY EURCAD SIMPLE S123

FX SCALPING LONDON SESSION, S1 EP6, BUY EURCAD SIMPLE S123

TWIN strategy Forex Mathematical Analysis 1 Month of

TWIN strategy Forex Mathematical Analysis 1 Month of

Forex Trading Strategy Session Technical Analysis, Swing

Forex Trading Strategy Session Technical Analysis, Swing

A Simple Forex Swing Trading Strategy Forex Scalping

A Simple Forex Swing Trading Strategy Forex Scalping

London Session Forex Breakout Strategy rfxsignals

London Session Forex Breakout Strategy rfxsignals

Forex Factory Breakout Strategy Forex Ea Trader Myfxbook

Characteristics of London Trading Sessions Forex Signals

Characteristics of London Trading Sessions Forex Signals

Daily Forex Trading Strategy Session Swing Trade Review

Daily Forex Trading Strategy Session Swing Trade Review

1 min forex scalping strategy with MACD filter Learn

1 min forex scalping strategy with MACD filter Learn

No comments:

Post a Comment